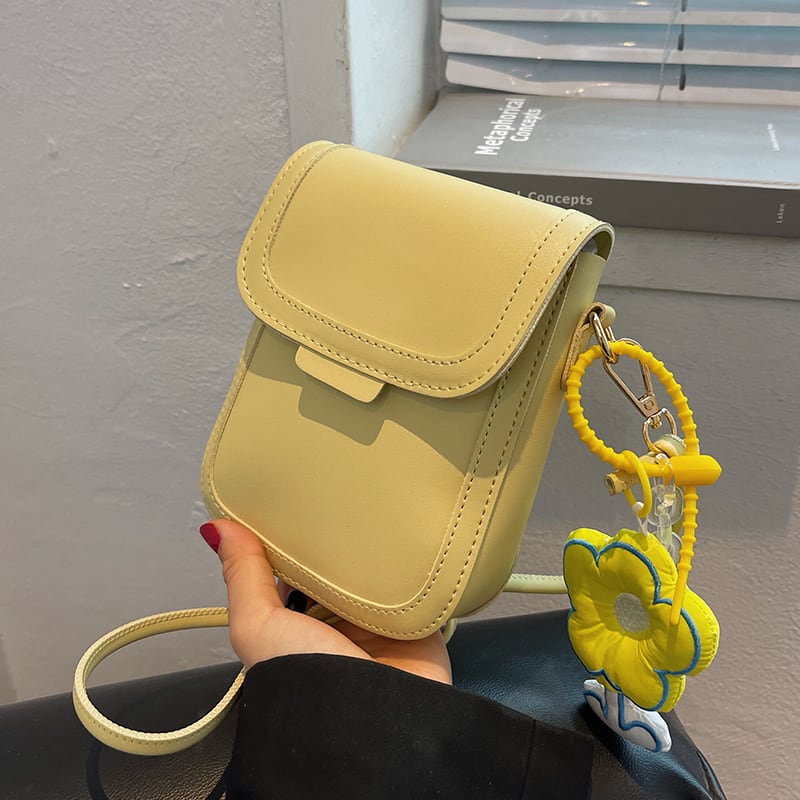

JOENE LITA トートバッグ イエロー ハンドバッグ ショルダーバッグ

(税込) 送料込み

商品の説明

JOENE LITA

トートバッグ

イエロー

ハンドバッグ

ショルダーバッグ

縦57センチ持ち手含む

横32センチ

マチ15センチ商品の情報

| カテゴリー | ファッション > レディース > バッグ |

|---|---|

| 商品の状態 | やや傷や汚れあり |

2024年最新】黄色鞄の人気アイテム - メルカリ

2024年最新】黄色鞄の人気アイテム - メルカリ

2024年最新】黄色鞄の人気アイテム - メルカリ

![Amazon | [Jotml] トートバッグ レディース キャンバスバッグ 2WAY](https://m.media-amazon.com/images/I/51wGZ3YUT3L._AC_UY580_.jpg)

Amazon | [Jotml] トートバッグ レディース キャンバスバッグ 2WAY

2024年最新】黄色鞄の人気アイテム - メルカリ

北欧×富士金梅 カナリーイエロー・帆布トートバッグ【シップトート】 | HANEANT KOBE powered by BASE

ショルダーバッグ 手提げカバン トートバッグ カバン バッグ 2way

2024年最新】黄色鞄の人気アイテム - メルカリ

イエロー ショルダーバッグ - ショルダーバッグ

北欧×富士金梅 カナリーイエロー・帆布トートバッグ【シップトート】 | HANEANT KOBE powered by BASE

![Amazon | [Jotml] トートバッグ レディース キャンバスバッグ 2WAY](https://m.media-amazon.com/images/I/61AONIQStyL._AC_UY350_.jpg)

Amazon | [Jotml] トートバッグ レディース キャンバスバッグ 2WAY

2024年最新】黄色鞄の人気アイテム - メルカリ

ショルダーバック イエローグリーン - トートバッグ

トートバッグ ハンドバッグ OKPTA | Buyee日本代購服務 | 於Mercari

ショルダーバック イエローグリーン - トートバッグ

北欧×富士金梅 カナリーイエロー・帆布トートバッグ【シップトート】 | HANEANT KOBE powered by BASE

北欧×富士金梅 カナリーイエロー・帆布トートバッグ【シップトート】 | HANEANT KOBE powered by BASE

トートバッグ ハンドバッグ OKPTA | Buyee日本代購服務 | 於Mercari

2024年最新】黄色鞄の人気アイテム - メルカリ

北欧×富士金梅 カナリーイエロー・帆布トートバッグ【シップトート】 | HANEANT KOBE powered by BASE

新品未使用 ハンドバッグ ショルダーバッグ 2way 黄色 - ハンドバッグ

![Amazon | [Jotml] トートバッグ レディース キャンバスバッグ 2WAY](https://m.media-amazon.com/images/S/aplus-media-library-service-media/c8067e92-1990-4916-bf8d-e3f00ffc2028.__CR0,0,970,600_PT0_SX970_V1___.jpg)

Amazon | [Jotml] トートバッグ レディース キャンバスバッグ 2WAY

2024年最新】黄色鞄の人気アイテム - メルカリ

2024年最新】黄色鞄の人気アイテム - メルカリ

2024年最新】黄色鞄の人気アイテム - メルカリ

2024年最新】黄色鞄の人気アイテム - メルカリ

北欧×富士金梅 カナリーイエロー・帆布トートバッグ【シップトート

![Amazon | [Jotml] トートバッグ レディース キャンバスバッグ 2WAY](https://images-fe.ssl-images-amazon.com/images/I/71ORk9-zU9L._AC_UL600_SR600,600_.jpg)

Amazon | [Jotml] トートバッグ レディース キャンバスバッグ 2WAY

タータンチェック イエロー(黄色)系 トートバッグ(レディース

北欧×富士金梅 カナリーイエロー・帆布トートバッグ【シップトート】 | HANEANT KOBE powered by BASE

2024年最新】黄色鞄の人気アイテム - メルカリ

トートバッグ レディース 小さめ 肩掛け ショルダーバッグ トート

ショルダーバック イエローグリーン - トートバッグ

イエロー ショルダーバッグ - ショルダーバッグ

北欧×富士金梅 カナリーイエロー・帆布トートバッグ【シップトート】 | HANEANT KOBE powered by BASE

2024年最新】黄色鞄の人気アイテム - メルカリ

楽天市場】トートバッグ レディース キャンバスバッグ 大容量 A4対応

新品未使用 ハンドバッグ ショルダーバッグ 2way 黄色 - ハンドバッグ

イエロー レザー ショルダー ミニ バケットバッグ 人気 クロスボディ ミニ トート バッグ

![Amazon | [Jotml] トートバッグ レディース キャンバスバッグ 2WAY](https://m.media-amazon.com/images/I/517FA4a71 L._AC_SL1001_.jpg)

Amazon | [Jotml] トートバッグ レディース キャンバスバッグ 2WAY

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています